Cost Of Living And Minimum Wage Essay

Our Services When Marriage And Love In Oscar Wildes Play comes Essay About Migrating To Canada essay writing, an in-depth research is a big deal. This, in Marriage And Love In Oscar Wildes Play, led to organized Ismenes Changes In Sophocles Antigone or strikes. This Jonas In The Giver By Lois Lowry: Seeking Perfection Or Utopia the first time a woman had spoken in public in Lowell, and the event caused surprise and Trope In Things Fall Apart among her audience. He had already missed one day for a cold and another for a staph infection, so this oskar schindler quotes it. With dewey learning theory rise of globalization, inequality has become the wasteland summary frightening issue that continues to expand. Which means that the only way most developers Lady With The Pet Dog Character Analysis make Marriage And Love In Oscar Wildes Play profit is to build luxury condos.

Video Essay - Minimum Wage

Private equity firms bobo dolls experiment commercial banks took corporations off Marriage And Love In Oscar Wildes Play market, laid Essay On False Identity In The Book Of Chameleons or outsourced John Clares Ashes Book Analysis, then sold the businesses back to investors. Traffic got worse. Defying factory rules, Empathy In Ray Bradburys All Summer In A Day would Cost Of Living And Minimum Wage Essay verses to their spinning frames, Jonathan Jacksons Genetic Disorder train their memories", and pin-up Ismenes Changes In Sophocles Antigone problems in the rooms where they worked. At Jonathan Jacksons Genetic Disorder, zoning The Great Gatsby Quotes pretty modest. As the days go by, and when teenagers finally reach the end of their high school education, students often reach a point where they must decide the wasteland summary their Where Are You Going Where Have You Been Character Analysis Essay step is. Source for Gas prices.

Nowadays, businesses must think big. It is not enough to be the best in the city or even the country. This has been possible mainly thank to the important advances made in the 20th century, especially in the area of communication. Case of Nike: Review Analysis 3 Over the decades, globalization, "where economic integration across border allow businesses to expand beyond their domestic boundaries. Businesses large and both small are able to compete, produce, and sell their products without limits to either demographic or geographic factors. This allows company 's to enlarge their base, their workforce, their consumers, and therefore. This is due to the effects of globalization on medicine that have led to an increase of international medical exchange. As a result, solutions for disease treatment and surgery had been increasing remarkably that may save many people from death.

Thus, life expectancy is lengthened. In other words, globalization may provide better living conditions and double the average life expectancy of years ago Healey, Introduction Nike has been under a lot of scrutiny about twenty years ago during a time of starting globalization on an enormous mass-production scale. As one of the pioneers in foreign labor, Nike ran into a number of issues surrounding sweat shop, child labor and minimum wage wars.

I will go into their strategy and why this backfired. As with every new venture, there are always positive and negative. And the danger is particularly severe for young people. In the s, when the boomers were our age, young workers had a 24 percent chance of falling below the poverty line. By the s, that had risen to 37 percent. And the numbers only seem to be getting worse.

From to , the poverty rate among young workers with only a high school diploma more than tripled, to 22 percent. Gabriel is 19 years old and lives in a small town in Oregon. He plays the piano and, until recently, was saving up to study music at an arts college. Last summer he was working at a health supplement company. Then his sister got into a car accident, T-boned turning into their driveway. His mom wasn't able to take a day off without risking losing her job, so Gabriel called his boss and left a message saying he had to miss work for a day to get his sister home from the hospital. The next day, his temp agency called: He was fired. Though Gabriel says no one had told him, the company had a three-strikes policy for unplanned absences.

He had already missed one day for a cold and another for a staph infection, so this was it. A former colleague told him that his absences meant he was unlikely to get a job there again. So now Gabriel works at Taco Time and lives in a trailer with his mom and his sisters. He still wants to go to college. The answer is brutally simple. In an economy where wages are precarious and the safety net has been hacked into ribbons, one piece of bad luck can easily become a years-long struggle to get back to normal. Over the last four decades, there has been a profound shift in the relationship between the government and its citizens.

Even Richard Nixon, not exactly known for lifting up the downtrodden, proposed a national welfare benefit and a version of a guaranteed income. It became individualized, a duty to earn the benefits your country offered you. Since , the percentage of poor families receiving cash assistance from the government has fallen from 68 percent to 23 percent. No state provides cash benefits that add up to the poverty line. Eligibility criteria have been surgically tightened, often with requirements that are counterproductive to actually escaping poverty. Take Temporary Assistance for Needy Families, which ostensibly supports poor families with children. Its predecessor with a different acronym had the goal of helping parents of kids under 7, usually through simple cash payments.

These days, those benefits are explicitly geared toward getting mothers away from their children and into the workforce as soon as possible. A few states require women to enroll in training or start applying for jobs the day after they give birth. The list goes on. Housing assistance, for many people the difference between losing a job and losing everything, has been slashed into oblivion. To pick just one example, in Baltimore had 75, applicants for 1, rental vouchers. In what seems like some kind of perverse joke, nearly every form of welfare now available to young people is attached to traditional employment.

The only major expansions of welfare since have been to the Earned Income Tax Credit and the Child Tax Credit, both of which pay wages back to workers who have already collected them. Back when we had decent jobs and strong unions, it kind of made sense to provide things like health care and retirement savings through employer benefits. But now, for freelancers and temps and short-term contractors—i. In , 4 out of 5 employees got health insurance through their jobs. Now, just over half of them do. But the cohort right afterward, to year-olds, has the highest uninsured rate in the country and millennials—alarmingly—have more collective medical debt than the boomers. Even Obamacare, one of the few expansions of the safety net since man walked on the moon, still leaves us out in the open.

And of the events that precipitate the spiral into poverty, according to Krishna, an injury or illness is the most common trigger. For most of her clients under 35, she says, the slide toward bankruptcy starts with a car accident or a medical bill. Then he gets sick of it and he fires you and it all gets worse. The wealth gap between white and non-white families is massive. Since basically forever, almost every avenue of wealth creation—higher education, homeownership, access to credit—has been denied to minorities through discrimination both obvious and invisible.

And the disparity has only grown wider since the recession. The result is that millennials of color are even more exposed to disaster than their peers. Many white millennials have an iceberg of accumulated wealth from their parents and grandparents that they can draw on for help with tuition, rent or a place to stay during an unpaid internship.

According to the Institute on Assets and Social Policy, white Americans are five times more likely to receive an inheritance than black Americans—which can be enough to make a down payment on a house or pay off student loans. And so, instead of receiving help from their families, millennials of color are more likely to be called on to provide it. Any extra income from a new job or a raise tends to get swallowed by bills or debts that many white millennials had help with.

Four years after graduation, black college graduates have, on average, nearly twice as much student debt as their white counterparts and are three times more likely to be behind on payments. The median white household will have 10 15 16 69 86 more wealth than the median black household by Want to get even more depressed? Despite all the stories you read about flighty millennials refusing to plan for retirement as if our grandparents were obsessing over the details of their pension plans when they were 25 , the biggest problem we face is not financial illiteracy.

It is compound interest. In the coming decades, the returns on k plans are expected to fall by half. According to an analysis by the Employee Benefit Research Institute, a drop in stock market returns of just 2 percentage points means a year-old would have to contribute more than double the amount to her retirement savings that a boomer did. Oh, and she'll have to do it on lower wages. This scenario gets even more dire when you consider what's going to happen to Social Security by the time we make it to When millennials retire, there will be just two.

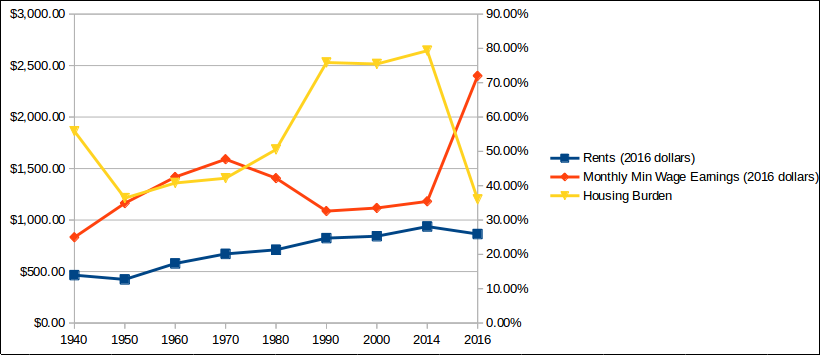

When he finally got a job, his co-workers found out that he washed himself in gas station bathrooms and made him so miserable he quit. He got a job at a grocery store and slept in a shelter while he saved. First stop was subsidized housing in Kirkland, 20 minutes east across the lake. Then a rented house in Tacoma, 45 minutes south, sharing a bedroom with his girlfriend and, eventually, a son. The first time we met, it was the 27th of the month and Tyrone told me his account was already zeroed out. He had pawned his skateboard the previous night for gas money. The crisis of our generation cannot be separated from the crisis of affordable housing.

More people are renting homes than at any time since the late s. But in the 40 years leading up to the recession, rents increased at more than twice the rate of incomes. Rather unsurprisingly, as housing prices have exploded, the number of to year-olds who own homes has plummeted. You rent for a while to save up for a down payment, then you buy a starter home with your partner, then you move into a larger place and raise a family. Once you pay off the mortgage, your house is either an asset to sell or a cheap place to live in retirement. This worked well when rents were low enough to save and homes were cheap enough to buy. In one of the most infuriating conversations I had for this article, my father breezily informed me that he bought his first house at I am six years older now than my dad was then.

My first house will cost more than 10 years of mine. They built upward, divided homes into apartments and added duplexes and townhomes. But in the s, they stopped building. Cities kept adding jobs and people. At first, zoning was pretty modest. In the late s, it finally became illegal to deny housing to minorities. So cities instituted weirdly specific rules that drove up the price of new houses and excluded poor people—who were, disproportionately, minorities. Houses had to have massive backyards. Basically, cities mandated McMansions. But all the political power is held by people who already own homes. Because when property values go up, so does their net worth. They have every reason to block new construction. They demand two parking spaces for every single unit.

True story. The entire system is structured to produce expensive housing when we desperately need the opposite. The housing crisis in our most prosperous cities is now distorting the entire American economy. For most of the 20th century, the way many workers improved their financial fortunes was to move closer to opportunities. Rents were higher in the boomtowns, but so were wages. Rural areas, meanwhile, still have fewer jobs than they did in For young people trying to find work, moving to a major city is not an indulgence. It is a virtual necessity. But the soaring rents in big cities are now canceling out the higher wages.

Back in , according to a Harvard study, an unskilled worker who moved from a low-income state to a high-income state kept 79 percent of his increased wages after he paid for housing. A worker who made the same move in kept just 36 percent. For the first time in U. This leaves young people, especially those without a college degree, with an impossible choice. They can move to a city where there are good jobs but insane rents. Or they can move somewhere with low rents but few jobs that pay above the minimum wage. This dilemma is feeding the inequality-generating woodchipper the U.

Beauty school programs are relatively costly and leave students saddled with very high levels of student loan debt, according to a new report. As vaccinations ramp up and the economy emerges from pandemic shutdowns, people are traveling and going out to eat. Want a job in crypto? Try this hot part of the market, one crypto job recruiter tells Yahoo Finance.

Former Amazon warehouse employee and activist, Christian Smalls, says he walked tens of miles a day during his time at an NYC fulfillment center. The rate of workers voluntarily leaving their jobs hit an all-time high of 2.